If you’ve tried buying a new-build home in Ottawa lately, you’ve likely noticed it’s a challenge, which is why we’ve put together this advice for buyers.

The COVID-19 pandemic took an already hot Ottawa market and turned it on its head. Analysts initially expected the market to tank, but the opposite has happened in the last 12-plus months. Too many buyers have been chasing too few homes, which get snapped up almost before they are released.

At the same time, builders have run into difficulty with material supplies, a pre-existing shortage of trades has been amplified, and costs to build a home have skyrocketed. Lumber alone soared to more than double typical pricing in the past year before finally starting to slide recently.

As a result, most builders in Ottawa have had to scale back their releases. Where once a development project might launch with 100 lots available, often now there might be a dozen, followed by a slow drip of subsequent releases so that builders can manage their timelines, construction costs and buyer expectations.

All of that has made it a challenge for buyers. In one example, Cardel Homes had 225 potential buyers interested in six townhomes being released. Valecraft Homes had 323 enter a lottery for 12 townhome lots.

So, what is a buyer to do?

The three Ps

Our advice for buyers comes down to the three Ps — patience, persistence and planning.

Pre-pandemic, it was common to make the decision to buy a new-build home, find a development you like, choose a lot and floor plan and sign a sales agreement, all in a short period of time and at your convenience. In most cases, that’s just not happening right now.

Many builder developments are chronically temporarily sold out. When a handful of lots are released, you need to know about them and be able to act quickly. That’s where the three Ps come in.

Our advice for buyers

The first P: Planning

The first thing you need to do is make sure you’ve done your homework. Because you will most likely have to act very quickly when lots in your desired development are released, you need to be ready.

Get your finances in order: Know what you can afford to spend on a home, get your mortgage pre-approval in place and have access to your down payment.

Have your lawyer lined up: Your lawyer will need to look over the sales agreement and you will have a time limit to get that done.

Do your research: Determine ahead of time which development or developments you would like to live in and research them. Check out the builder, review the site plan and identify lots you’d like, research the area to ensure it will meet your needs, go over the floor plans and shortlist your favourites. Note that many builders are not currently including pricing on their websites. Prices are changing so often that prices listed for a particular release will be out of date by the next release.

The second P: Persistence

Once you’ve narrowed down where you’d like to live and what type of home you want, you need to get proactive. Join the builder’s registration list — this is one of the easiest ways to stay informed about new releases and what’s happening with the development.

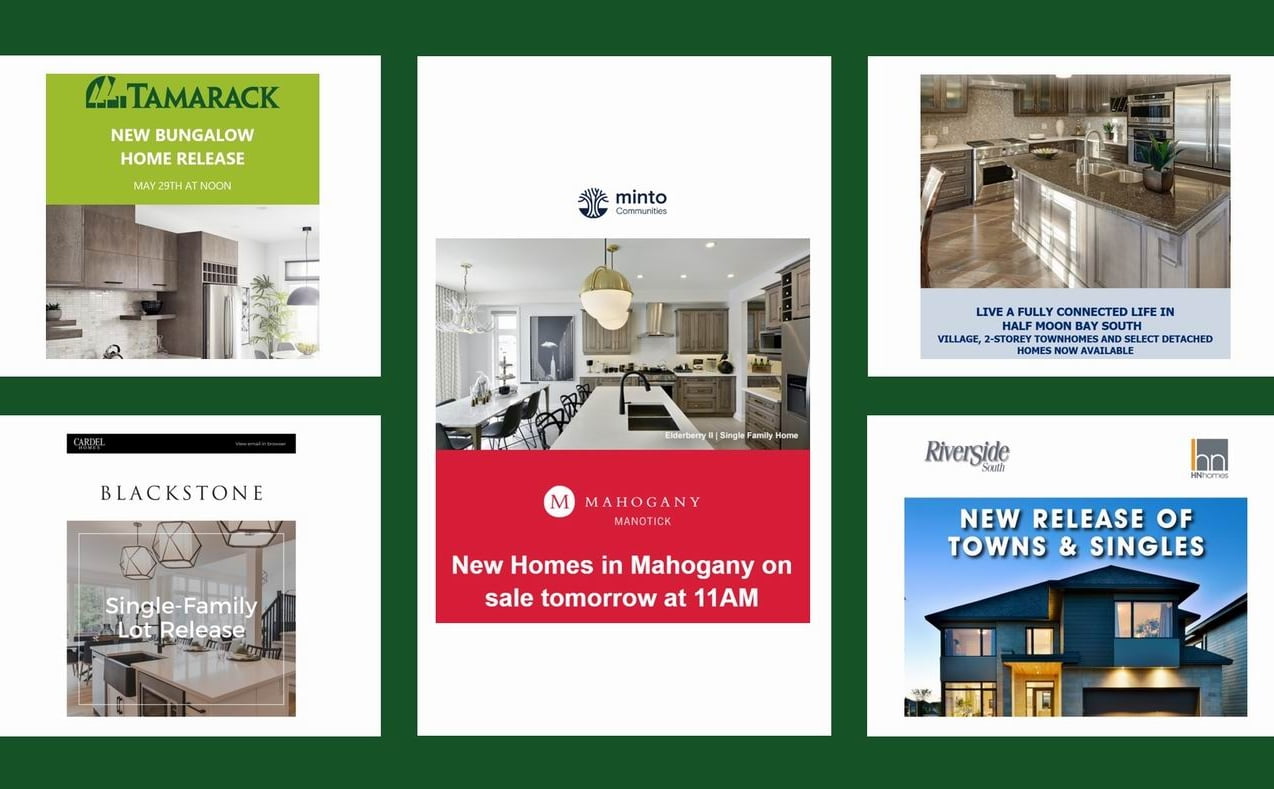

Most builders will email those on their registration list to give them a heads up about upcoming releases. And for new development launches, builders will often work through their registration list before launching a project to the public. These are referred to as VIP or friends and family launches.

Then take it a step further. Get to know the sales representatives at the development you want to buy in. Creating a relationship with the sales reps can be hugely helpful, particularly when it comes to answering any questions you may have so that you’re ready to make a decision when you get the chance to jump on a lot release.

Consider quick occupancy homes: Also known as move-in-ready or inventory homes, these are homes the builder has gone ahead and built before someone has bought them. There are different reasons why a tract builder will build a home before it’s sold, and there aren’t as many available these days as there might be in a more typical Ottawa market, but a quick occupancy home could be another option.

The drawback of a quick occupancy home is that you don’t have the choice in floor plans, finishes or lots. But the upside is that you also don’t have the long wait to have a new home built. We list some of the builder quick occupancy homes available and you can find others by checking the builders’ websites directly.

The third P: Patience

This is one buyers often don’t like to hear, but you do need to be patient. With so many buyers looking for so few homes, it will likely take some time to get the home you want in the development you want.

Builders use different methods when it comes to releasing lots. Many opt for the first-come, first-served method. In these days of virtual releases, that means buyers who are first to get their emails in to the builder at a pre-set time will get the first crack at lots being released. Other builders will use a lottery system.

Either way, if you’re one of the lucky ones to make it to the front of the line, you’ll need to act quickly to make your decision. This is why you need to be prepared. Builders will give you time to make your decision, within reason, but you will need to be ready to reserve a lot right away (with a deposit) and then be ready to make a commitment at a follow-up appointment with the sales rep, which typically happens within the next week.

Although recent signs indicate Ottawa’s red hot market may be starting to return to normal, it will take time for us to reach a more balanced market. Cheryl Rice, who is Ottawa president of industry analyst PMA Brethour Realty Group, expects that to happen later this year or early in 2022.

In the meantime, if you’re looking now, our advice for buyers is to start your planning, be persistent and have patience.