The slump continues as November 2022 new-home sales show yet another month of poor performance.

“The 2022 Ottawa housing market is likely to go down in history as the year when new-home sales experienced the fastest and sharpest rise and fall our market has seen in decades,” says Cheryl Rice, Ottawa president of industry analyst PMA Brethour Realty Group.

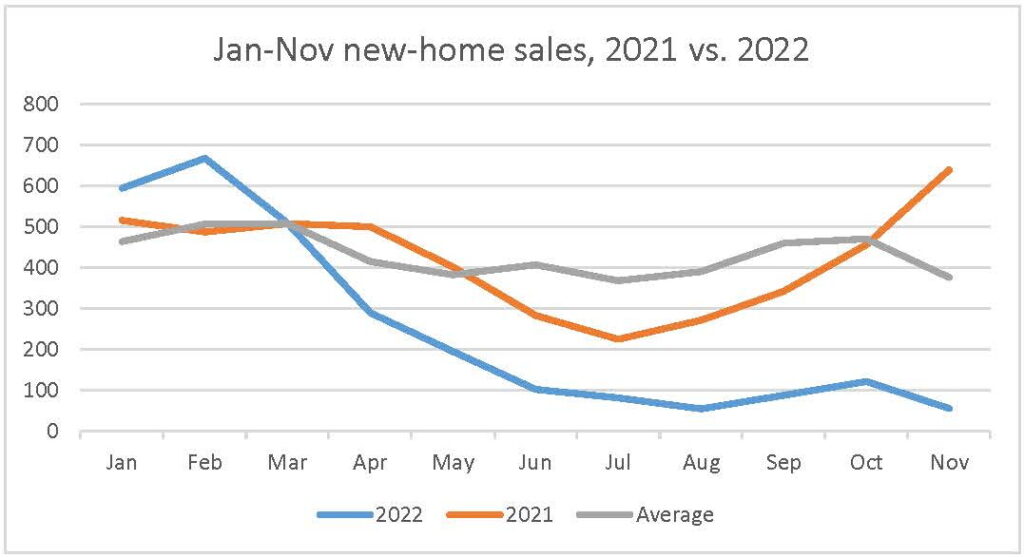

In its latest monthly market report, prepared for the Greater Ottawa Home Builders’ Association, PMA notes there were just 56 new homes sold in November, the lowest November result since 1981 and a 92-per-cent plunge from Ottawa’s sales peak in February of 677 new homes sold.

This November’s sales were also an almost-92-per-cent drop from November last year, which saw 639 sales.

And it was a drop of 54 per cent from the 122 sales recorded in October. For the year to date, sales are down 40 per cent (2,760 sales this year versus 4,629 last year).

“The slowdown in the market was inevitable, in fact necessary, following years of heightened demand, frantic buying and substantial and frequent price increases in both resale and new-home markets,” Rice notes.

Although not as drastic as the new-home market slump, Ottawa’s resale market has similarly been lethargic, with November numbers down 42 per cent over November 2021.

“Higher interest rates and other measures were introduced to slow demand and battle rising inflation, but ultimately forced most consumers to slam the brakes on major purchase decisions such as buying a new home,” Rice says.

The Bank of Canada’s (BoC) most recent 0.50 per cent interest rate hike, which increased the key rate to 4.25 per cent, was the seventh and last increase of 2022, she notes. “The language used by the BoC hinted that large rate increases are probably a thing of the past, and that future rate decisions will consider new economic data. This last rate increase is void of short-term relief for the consumer, but is, according to economists, a positive signal.”

Rice has noticed that builders continued to offer significant incentives to buyers in November, “but some builders have been pulling back on discounts and bonuses, instead reducing their prices to align with current market conditions and value.”