Ottawa’s 2023-24 housing market was and will be a mixed bag for homebuyers and builders alike, but time, patience and confidence will yield a brighter future.

That was the message Cheryl Rice, Ottawa president of industry analyst PMA Brethour Realty, delivered during her annual presentation on the local housing market at Hello 2024 / Goodbye 2023, organized by the Greater Ottawa Home Builders’ Association (GOHBA).

Everything from high inflation and climbing interest rates to buyers unwilling or unable to make the purchasing plunge meant 2023, like 2022, was rough for the local housing industry, according to Rice. But while buyers kept their chequebooks clamped tight and the industry struggled with continued weak sales, “in some ways the numbers aren’t as bad as you think and there are some bright spots.”

Better yet for the audience of battered builders and supporting industries, Rice said PMA believes the worst of Ottawa’s 2023-24 housing market is over, although she added a caveat. “We think the fall and winter of 2023 and 2024 marks the bottom of the market correction. But that doesn’t mean we’re not in for a bumpy ride, especially in the first half of this year.”

By the numbers

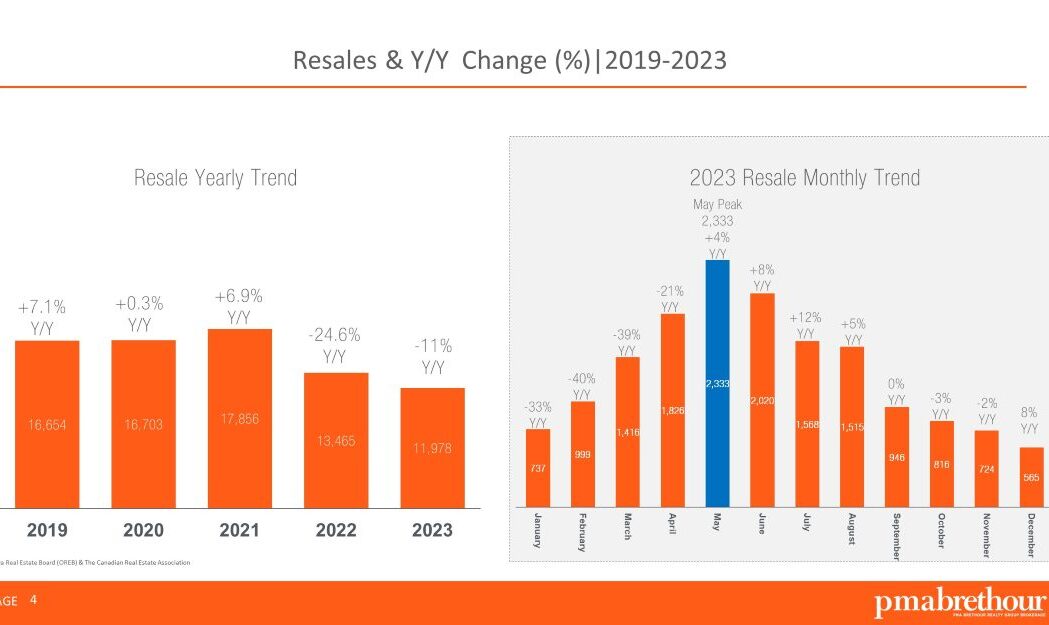

As always, Rice spent time dissecting the resale market, explaining that resale homes constitute the bulk of Ottawa’s housing stock and that the market is an important driver of trends in overall house pricing and supply.

Resales thrived during the pandemic of 2020 and 2021 as buyers, impelled at least in part by FOMO (fear of missing out), snapped up homes, prices soared and inventory shrank. The frantic activity ground to a halt in 2022, with sales tumbling almost 25 per cent from the previous year as buyers confronted inflation and other factors, including an inability to qualify for a mortgage at higher interest rates.

Resales got off to a more promising start in 2023, but multiple interest rate increases soon put the kibosh on that, explained Rice, with sales falling 11 per cent from the previous year. “Waiting for either a shift in home prices or a pause in interest rate (increases), buyers sat on the fence right until the end of the year.”

MORE: Resales dip to a 10-year low in 2023

On the plus side, by the end of 2023, the resale homes scene had shifted from a seller’s market to a balanced one with a reasonable supply of homes and prices rising only slightly. That “bodes well for 2024.”

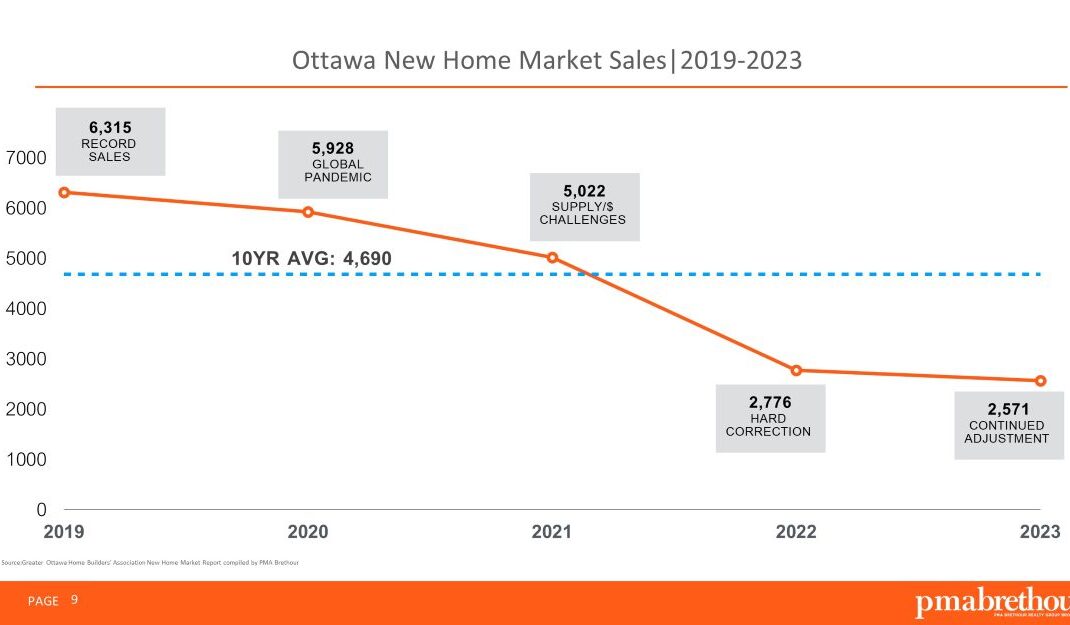

The new-home market continued to fare well during most of the pandemic, with sales exceeding the 10-year average. But then rising costs, shrinking supply and other factors kicked in, driving sales sharply downward in 2022 and to a 40-year low in 2023.

Surprisingly, sales centre traffic was increasing in 2023 and sales some months were significantly higher than 2022 (August 2023 sales were an astounding 207 per cent higher year-over-year). But last year’s sales remained stubbornly far below the 10-year average as a series of interest rate increases put a new-build home beyond the reach of many buyers and convinced others to wait and see.

Homebuilders responded by decreasing some prices, bringing the average price of singles below $1 million and townhomes below $700,000 for the first time since 2022. They also beefed up incentives and modified product lines to address affordability.

There were other bright spots, Rice noted. Sales in outlying areas, especially Embrun, were healthy and, with the exception of condo apartments, inventory increased and is now balanced with demand.

In the end, it made little difference: Ottawa homebuilders sold only 2,572 new homes last year, 45 per cent less than the 10-year average of 4,690 — “2023 was a tough year,” said Rice.

Ottawa’s 2023-24 housing market: Survive to thrive

Noting that there is pent-up demand and anticipating an interest rate cut in the spring, Rice expects home sales to remain stable this year, although there will be volatility. However, as she pointed out, a stable or even growing market will require a continued decline in inflation, interest rate decreases and that there are no major events to disrupt the global order.

She listed several items on PMA’s radar this year.

Affordability is a key one. “With high prices and interest rates having created a barrier for buyers for quite some time now, the consumer needs a signal to get back into the market. Buyer sentiment is going to play a huge role in prices. If the consumer thinks prices are too high and are going to come down, that’s all it’s going to take for them to stay on the fence.”

Innovation is also critical this year. She praised local builders for recent initiatives that have helped make homes more affordable, especially for first-time buyers, from three-storey singles and more stacked townhomes to towns without garages or finished basements. “The market spoke and you guys listened. That’s why I think 2024 is going to bring an explosion of more affordable housing products.“

MORE: Minto launches three-storey singles in Stittsville

Rice also noted how the high volume of immigration over the past few years has placed pressure on housing, questioned the possibility of the province’s plan to reach its goal of 1.5 million new homes by 2031, and predicted that the current injection of new purpose-built rentals should slow the rapid increase in rental rates.

Historically, market corrections ratchet down slowly, new-build home sales take time to recover and a drop in interest rates is essential to both, according to Rice. Consequently, sales are expected to be slower in the first half of the year with momentum building in the last half, leading to a “more fulsome” recovery in 2025.

“In the words of PMA’s chairman Andy Brethour, ‘Survive in 2024 and you will thrive in 2025.’”