In what is typically a good month for new-home sales, the September 2021 results suggest the pandemic sales frenzy has ended.

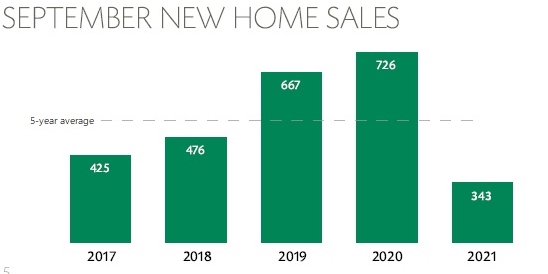

Ottawa new-home sales in September were 343, down 52 per cent compared to the 726 sold a year ago, according to the latest monthly report prepared by industry analyst PMA Brethour Realty on behalf of the Greater Ottawa Home Builders’ Association.

September 2020 was an unusually busy month for sales, attributed to pent-up demand stemming from the spring pandemic lockdown that year. Even so, this September’s sales fell 35 per cent below the five-year average of 527 for the month.

In fact, monthly new-home sales have been below the five-year average since May.

And looking at the year to date, sales this year (3,534) were 26-per-cent lower than last year (4,778).

“Since spring of this year, when new-home sales were strongest and prices at their peak, the Ottawa new-home market has continued on its path to stabilization,” says Cheryl Rice, who is president of PMA’s Ottawa branch.

“This stabilization, where supply and demand are in a more balanced state, is in part the result of new-home prices hitting a ceiling that the Ottawa consumer can no longer afford. In response, many builders are pumping the breaks on price increases and offering buyer incentives to generate sales.”

As it has all year, the south end of the city captured the highest market share of sales, although for the first time in September that share dipped below 50 per cent, reaching 44 per cent for the month.

Townhomes tank

And, as has been the case since the spring, more than half of sales were single-family homes. Typically, singles and townhomes will balance out in terms of market share, but they’ve tilted in favour of singles since May.

“Townhome sales, in particular, have stalled at many projects across the city,” Rice says, because “the affordable townhome is no longer affordable, especially for many first-time homebuyers.”

As well, she notes that the price gap between towns and smaller singles has been shrinking. “From the consumer’s perspective, the price-value equation of purchasing a smaller single over a townhome is the better value proposition, so they’ll lean towards that product type, if they can afford it.”

Affordability, says Rice, “continues to be a major choke point for many buyers. High prices, larger down payments, and the inability to obtain financing are posing significant challenges for many.”

A “ray of hope for some,” she notes, is that the rate of price increases “is slowing to a more modest pace and inventory levels are relatively high compared to previous periods.

“This presents buyers with some advantages, such as more choice, bigger incentives, and less pressure to buy on the spot. FOMO — the fear of missing out — has dissipated into thin air.”